Are you searching for a financial advisor to help you manage your finances, achieve your financial goals, and secure your future? With so many financial advisors out there, it can be overwhelming to choose the right one. A good financial advisor can make a significant difference in your financial well-being, which is why it's crucial to take the time to find the right fit. In this article, we'll provide you with a smart guide to interviewing financial advisors, helping you make an informed decision and find the perfect partner for your financial journey.

Why Interviewing Financial Advisors is Crucial

Interviewing financial advisors is an essential step in finding the right professional to manage your finances. It's an opportunity to assess their expertise, experience, and approach to financial planning, as well as their communication style and compatibility with your needs and goals. A good financial advisor will take the time to understand your financial situation, goals, and risk tolerance, and provide personalized advice and guidance to help you achieve your objectives.

Preparing for the Interview

Before interviewing financial advisors, it's essential to prepare a list of questions to ask. This will help you assess their qualifications, experience, and approach to financial planning. Some questions to consider include:

What experience do you have in financial planning and wealth management?

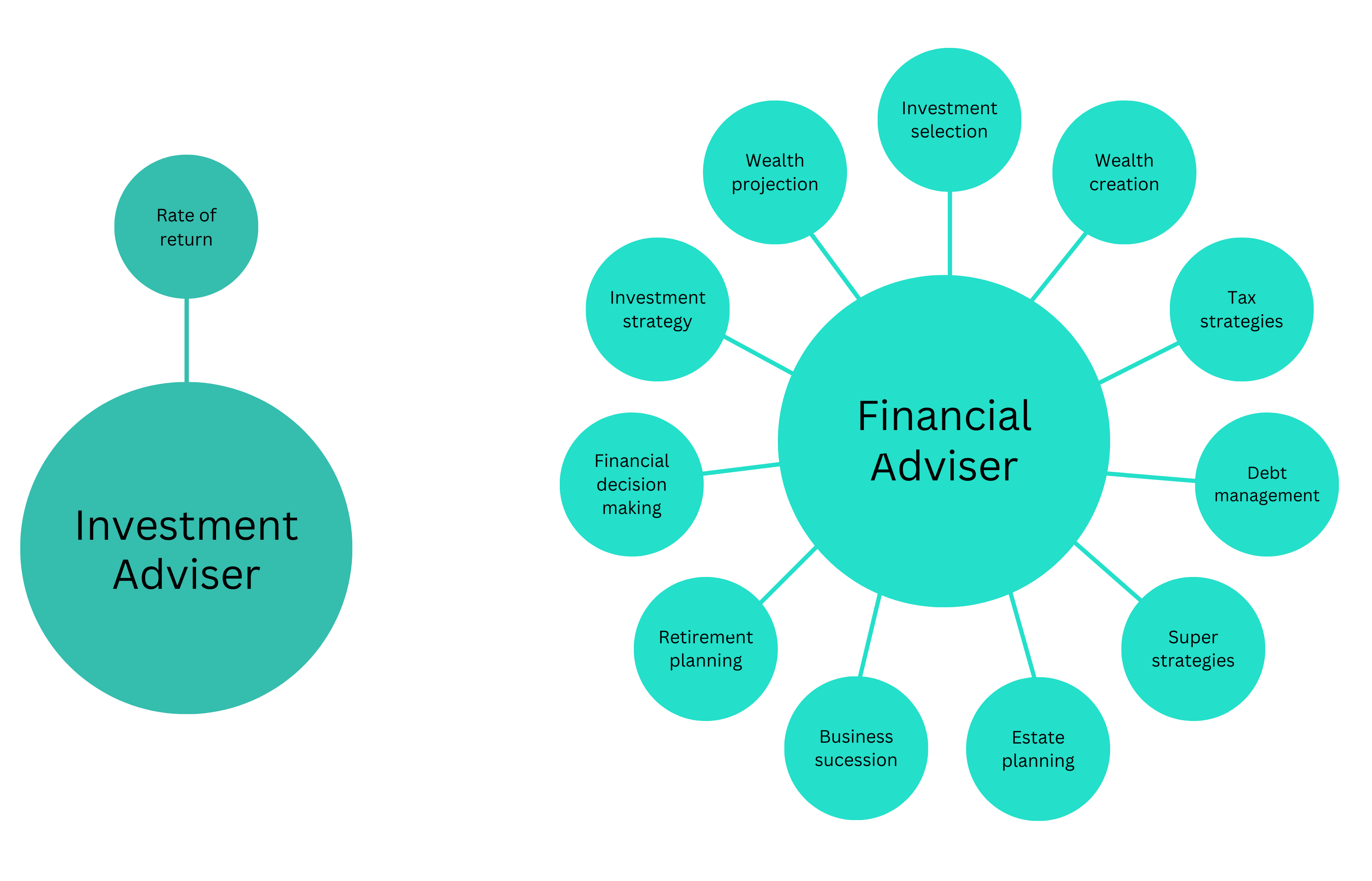

What services do you offer, and how will you help me achieve my financial goals?

What is your investment philosophy, and how do you approach risk management?

How will you communicate with me, and how often can I expect to hear from you?

What are your fees, and how are they structured?

Red Flags to Watch Out For

When interviewing financial advisors, there are several red flags to watch out for. These include:

Lack of transparency: If the advisor is evasive or secretive about their fees, services, or investment strategies, it may be a sign of a lack of transparency.

Aggressive sales tactics: If the advisor is pushy or aggressive in their sales approach, it may be a sign of a focus on commissions rather than your best interests.

Lack of experience: If the advisor lacks experience or qualifications, it may be a sign of a lack of expertise.

What to Look for in a Financial Advisor

When interviewing financial advisors, there are several key qualities to look for. These include:

Experience and qualifications: Look for advisors with relevant experience and qualifications, such as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designation.

Strong communication skills: A good financial advisor should be able to communicate complex financial concepts in a clear and concise manner.

Personalized approach: Look for advisors who take the time to understand your unique financial situation, goals, and risk tolerance.

Fees and services: Look for advisors who are transparent about their fees and services, and who offer a range of services to meet your needs.

Choosing the right financial advisor is a critical decision that can have a significant impact on your financial well-being. By taking the time to interview financial advisors and asking the right questions, you can find a professional who is well-suited to your needs and goals. Remember to look for experience, strong communication skills, and a personalized approach, and be wary of red flags such as lack of transparency or aggressive sales tactics. With the right financial advisor by your side, you can achieve your financial goals and secure your future.

By following this smart guide to interviewing financial advisors, you'll be well on your way to finding the perfect partner for your financial journey. Don't settle for anything less than the best – take the time to find a financial advisor who is dedicated to helping you achieve your financial goals.

:max_bytes(150000):strip_icc()/GettyImages-523110014-f334f5023c6f48df8f398ee1c1ceefe1.jpg)