Table of Contents

- Irmaa 2024 Brackets And Premiums Chart Pdf - Risa Verile

- 2025 Irmaa Limits - Matti Shelley

- 2025 Part D Irmaa Brackets - Adrian Roberts

- Possible 2025 IRMAA Brackets

- Irmaa 2025 Brackets And Premiums Chart Of Accounts - Jeffrey L. Werner

- what are the irmaa brackets for 2023

- Irmaa 2024 Brackets And Premiums Chart - Manda Rozanne

- what are the irmaa brackets for 2023

- Irmaa Brackets 2025 And 2026 - Mufi Tabina

- Irmaa Brackets 2025 - Karen Arnold

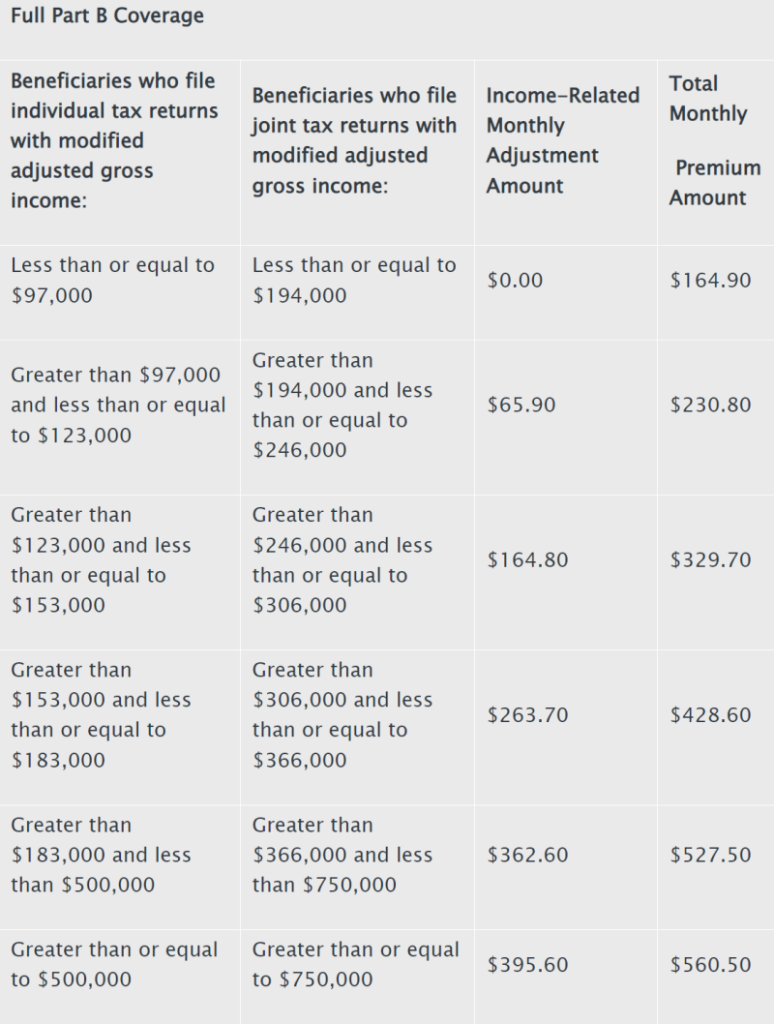

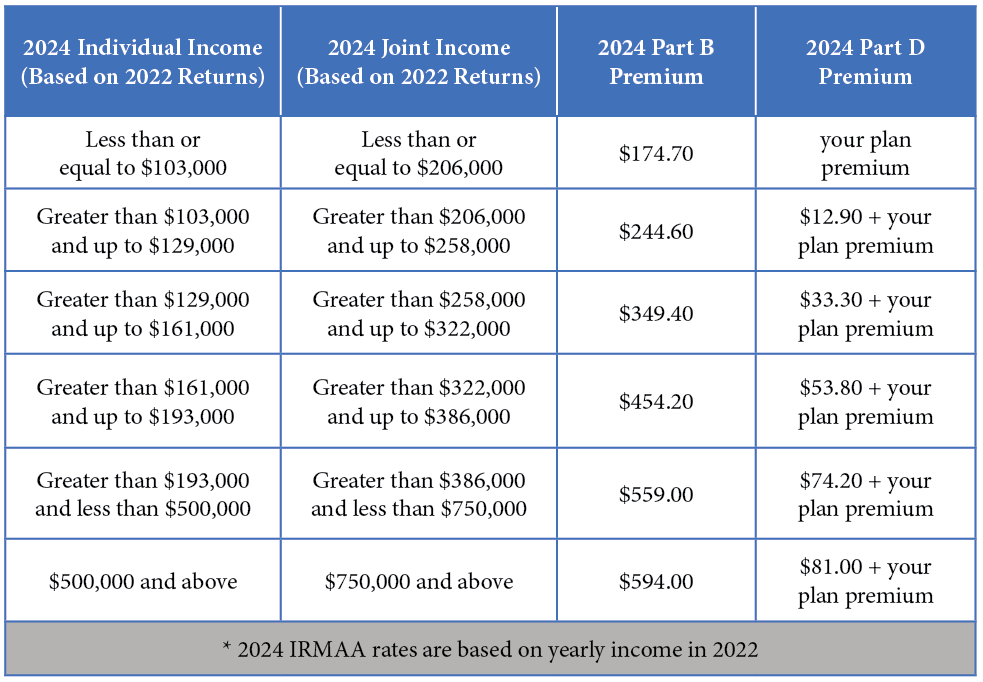

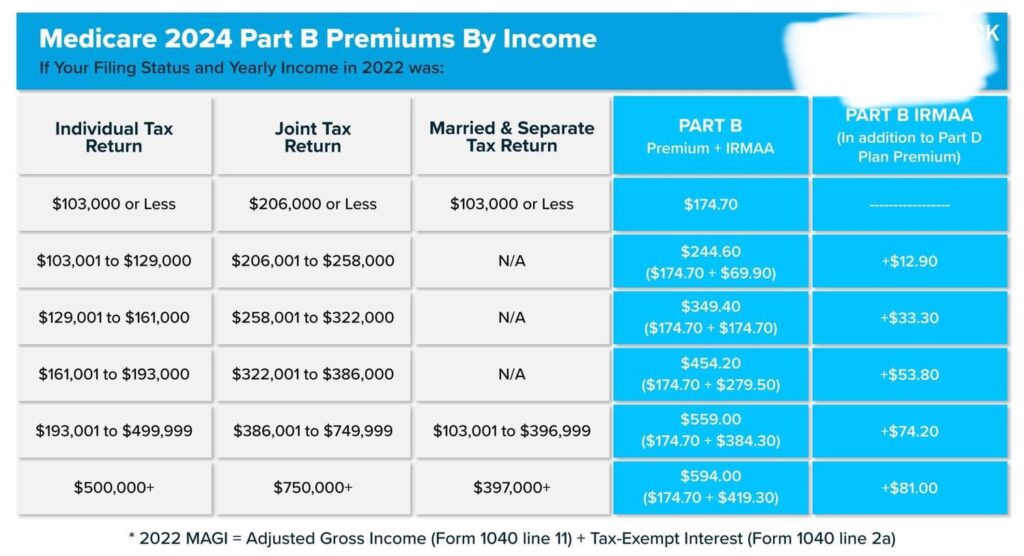

Understanding IRMAA Brackets

2025 IRMAA Brackets

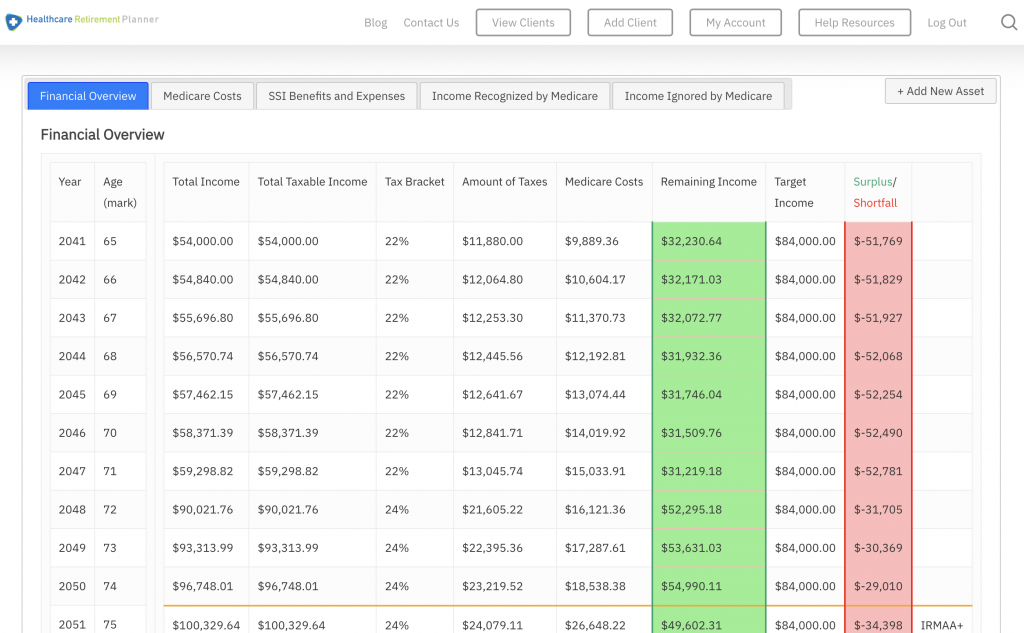

Impact on Medicare Beneficiaries

The 2025 IRMAA brackets will have a significant impact on Medicare beneficiaries with higher incomes. Those who fall into the higher income brackets will see an increase in their Medicare Part B and Part D premiums. However, it's essential to note that the IRMAA surcharge is only applied to the Medicare Part B premium, not the Medicare Part D premium.

Tips for Managing IRMAA Surcharges

To minimize the impact of the IRMAA surcharge, beneficiaries can consider the following: Review and adjust income: Beneficiaries can review their income and adjust it accordingly to avoid falling into a higher IRMAA bracket. Consider a Medicare Advantage plan: Medicare Advantage plans may offer lower premiums and additional benefits, which can help offset the IRMAA surcharge. Seek professional advice: Beneficiaries can consult with a licensed insurance agent or financial advisor to determine the best course of action. The 2025 IRMAA brackets will bring changes to Medicare Part B and Part D premiums for beneficiaries with higher incomes. Understanding the new brackets and how they will impact premiums is essential for making informed decisions about Medicare coverage. By reviewing the 2025 IRMAA brackets and considering tips for managing IRMAA surcharges, beneficiaries can navigate the complex world of Medicare premiums and ensure they receive the best possible coverage.Stay informed about the latest Medicare updates and changes by visiting our website regularly. Our team of experts is dedicated to providing you with the most up-to-date information and guidance on Medicare and related topics.