Are you struggling to pay your tax debt in full? You're not alone. Many individuals and businesses face challenges when it comes to paying their tax liabilities. Fortunately, the Internal Revenue Service (IRS) offers a payment plan option that can help make paying your tax debt more manageable. In this article, we'll walk you through the process of setting up a payment plan with the IRS, as outlined by

Bankrate.

Understanding Your Options

Before setting up a payment plan, it's essential to understand your options. The IRS offers several payment plans, including:

Short-term payment plan: This plan allows you to pay your tax debt in full within 120 days or less.

Long-term payment plan: This plan allows you to pay your tax debt in monthly installments over a period of more than 120 days.

Currently Not Collectible (CNC) status: If the IRS determines that you're unable to pay your tax debt, they may place your account in CNC status, which temporarily suspends collection activities.

Eligibility Requirements

To be eligible for a payment plan, you must meet the following requirements:

You must owe $50,000 or less in combined tax, interest, and penalties.

You must have filed all required tax returns.

You must not have an open bankruptcy case.

How to Set Up a Payment Plan

Setting up a payment plan with the IRS is a relatively straightforward process. Here are the steps to follow:

1.

Gather required information: You'll need to provide your name, address, Social Security number or Individual Taxpayer Identification Number (ITIN), and the amount you owe.

2.

Choose your payment method: You can pay by check, money order, credit card, or electronic funds withdrawal.

3.

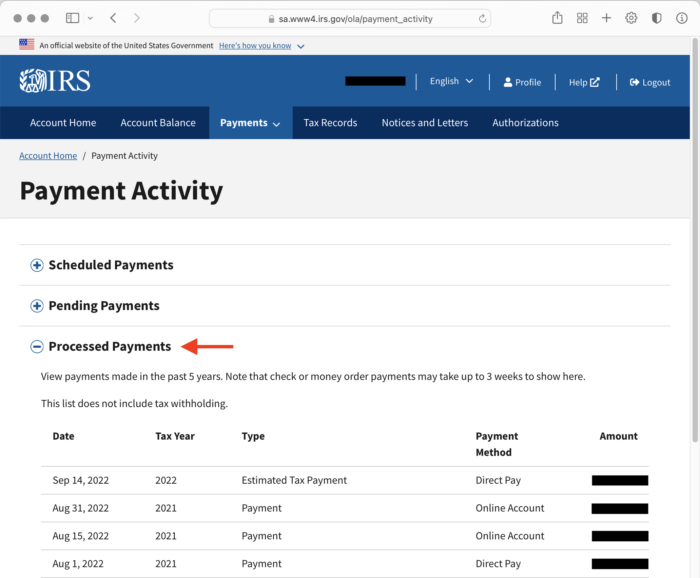

Apply online or by phone: You can apply for a payment plan online through the

IRS website or by calling the IRS at 1-800-829-1040.

4.

Make your first payment: Once your payment plan is approved, make your first payment to avoid additional penalties and interest.

Benefits of a Payment Plan

Setting up a payment plan with the IRS can provide several benefits, including:

Avoiding additional penalties and interest: By making timely payments, you can avoid additional penalties and interest on your tax debt.

Preventing collection activities: A payment plan can prevent the IRS from taking further collection actions, such as levying your bank account or wages.

Reducing financial stress: A payment plan can help you manage your tax debt and reduce financial stress.

Setting up a payment plan with the IRS can be a viable option if you're struggling to pay your tax debt in full. By understanding your options, eligibility requirements, and the application process, you can take control of your tax debt and avoid additional penalties and interest. Remember to make timely payments and communicate with the IRS to ensure a successful payment plan. For more information, visit the

Bankrate website or consult with a tax professional.

Note: The information provided in this article is for general purposes only and should not be considered as tax advice. It's always recommended to consult with a tax professional or the IRS directly for specific guidance on setting up a payment plan.