Table of Contents

- TSM Stock Price and Chart — NYSE:TSM — TradingView

- TSM - Taiwan Semiconductor Manufacturing Company Limited | Stock Quote ...

- TSM Stock Higher? How Wealthy Investors Trade Taiwan Semiconductor ...

- Stocks Soar, Set to Recover Yesterday's Losses

- TSM Stock Price and Chart — TradingView

- Taiwan Semiconductor (TSM) Stock Trading Sideways No More - TheStreet

- Will TSMC Be a Trillion-Dollar Stock by 2025? | The Motley Fool

- TSM Stock Price and Chart — NYSE:TSM — TradingView

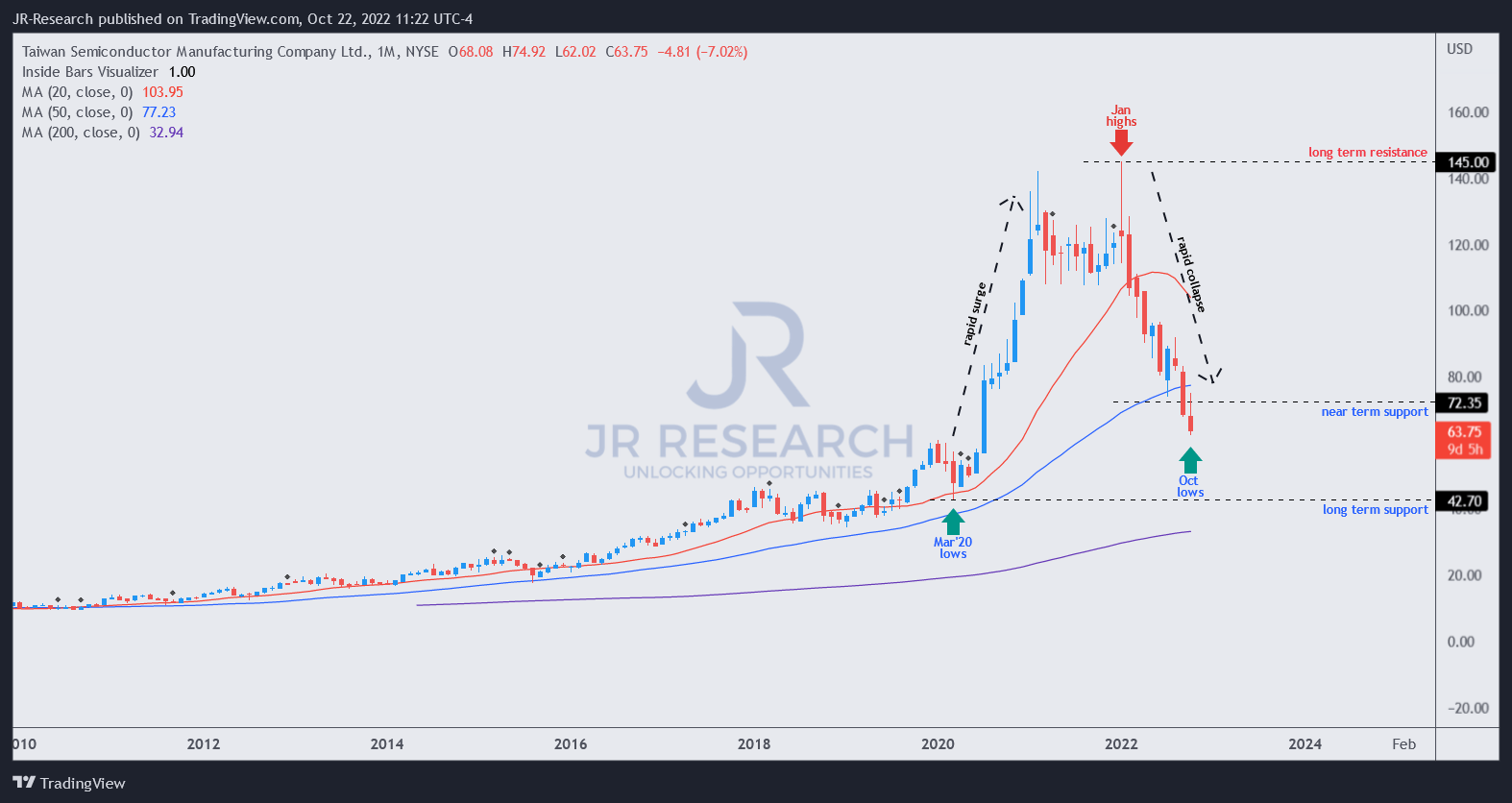

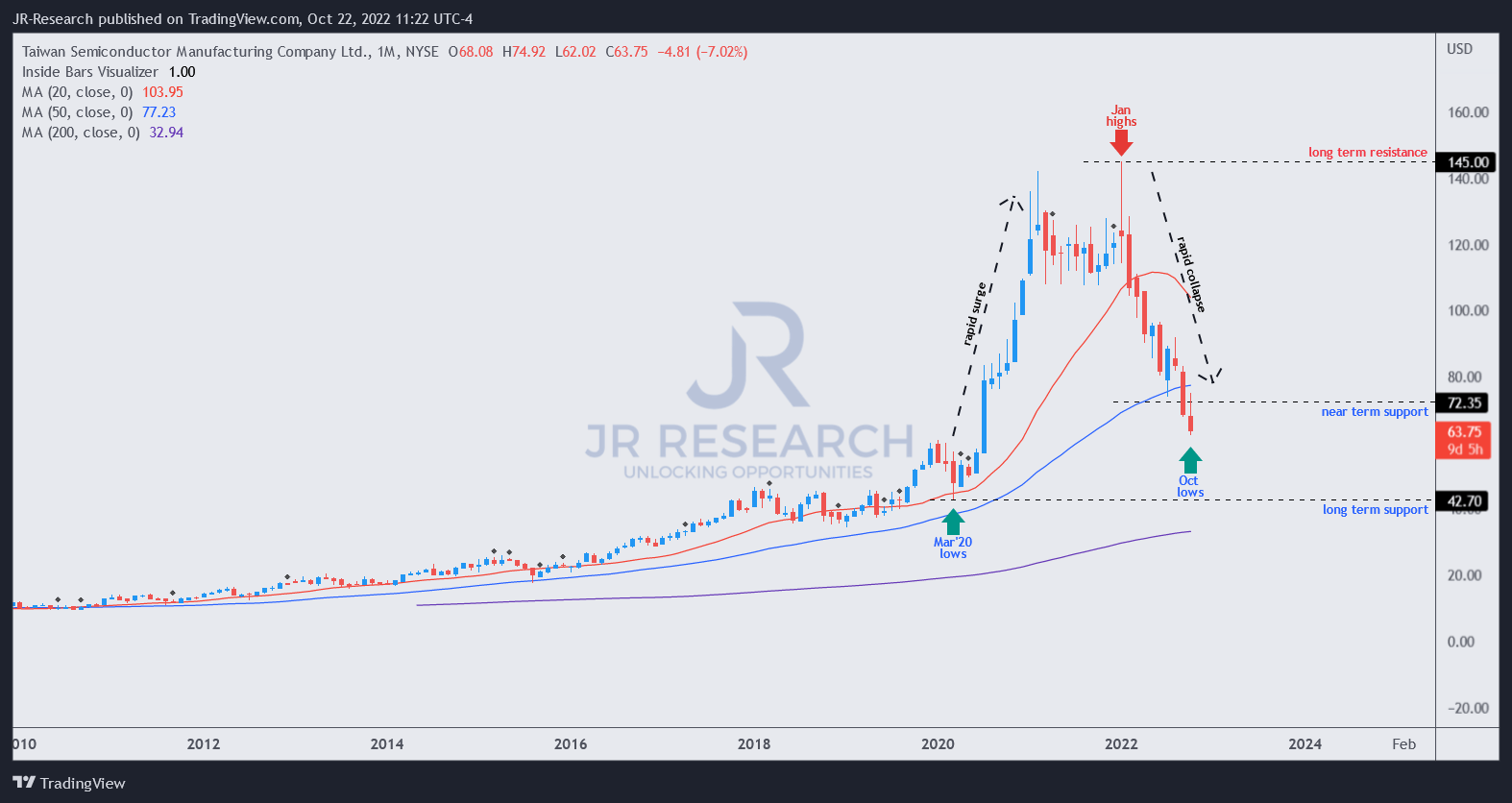

- Taiwan Semiconductor: These Levels Are Too Attractive Not To Start ...

- Taiwan Semiconductor: These Levels Are Too Attractive Not To Start ...

Taiwan Semiconductor Manufacturing Company (TSM) is one of the world's leading independent semiconductor foundries, playing a crucial role in the global technology industry. As a key player in the production of microchips, TSM's stock price and performance are closely watched by investors, analysts, and industry experts. In this article, we will delve into the latest news, analysis, and trends surrounding TSM stock, providing insights into its current price, future prospects, and potential investment opportunities.

TSM Stock Price: Recent Performance and Trends

As of the latest market data, TSM's stock price has been experiencing a significant surge, driven by the increasing demand for advanced semiconductor technologies. The company's shares have been trading at an all-time high, with a market capitalization of over $200 billion. This upward trend is expected to continue, driven by the growing adoption of 5G technology, artificial intelligence, and the Internet of Things (IoT).

The TSM stock price has been influenced by various factors, including the company's strong financial performance, strategic partnerships, and investments in research and development. The company's revenue has consistently grown over the years, with a compound annual growth rate (CAGR) of over 10%. This growth is expected to continue, driven by the increasing demand for semiconductor products in various industries, including consumer electronics, automotive, and industrial manufacturing.

Latest News and Developments

Recently, TSM announced a significant investment in the development of 3-nanometer (3nm) technology, which is expected to further enhance the company's competitiveness in the global semiconductor market. This investment is part of the company's strategy to stay ahead of the curve in terms of technology and innovation, and to meet the growing demand for advanced semiconductor products.

Additionally, TSM has been expanding its partnerships with leading technology companies, including Apple, Qualcomm, and NVIDIA. These partnerships are expected to drive growth and revenue for the company, as well as enhance its position in the global semiconductor market. The company has also been investing in the development of new technologies, including 5G, AI, and IoT, which are expected to drive future growth and innovation.

Analysis and Outlook

Based on the current trends and developments, TSM's stock price is expected to continue its upward trend, driven by the growing demand for advanced semiconductor technologies. The company's strong financial performance, strategic partnerships, and investments in research and development are expected to drive growth and revenue, making it an attractive investment opportunity for investors.

However, there are also potential risks and challenges that investors should be aware of, including the intense competition in the global semiconductor market, the impact of trade tensions and geopolitical uncertainties, and the potential for supply chain disruptions. Despite these risks, TSM's strong track record and commitment to innovation and customer satisfaction make it a solid investment opportunity for those looking to invest in the technology sector.

Taiwan Semiconductor Manufacturing Company (TSM) is a leading player in the global semiconductor industry, with a strong track record of innovation and customer satisfaction. The company's stock price has been experiencing a significant surge, driven by the growing demand for advanced semiconductor technologies. With its strong financial performance, strategic partnerships, and investments in research and development, TSM is expected to continue its growth and revenue, making it an attractive investment opportunity for investors. As the demand for semiconductor products continues to grow, TSM is well-positioned to capitalize on this trend and drive future growth and innovation.

Investors looking to invest in the technology sector should consider TSM's stock, given its strong fundamentals and growth prospects. However, it's essential to conduct thorough research and analysis before making any investment decisions, taking into account the potential risks and challenges facing the company and the industry as a whole.