Table of Contents

- Target Stock Gaps Higher on Earnings Beat

- Target — Stock Photo © Jura1966 #3572027

- Near a 52-Week Low, Is Target’s Stock a Retail Bargain? - The Globe and ...

- Is Target Stock Aiming for a Breakout in 2023? | Investing.com

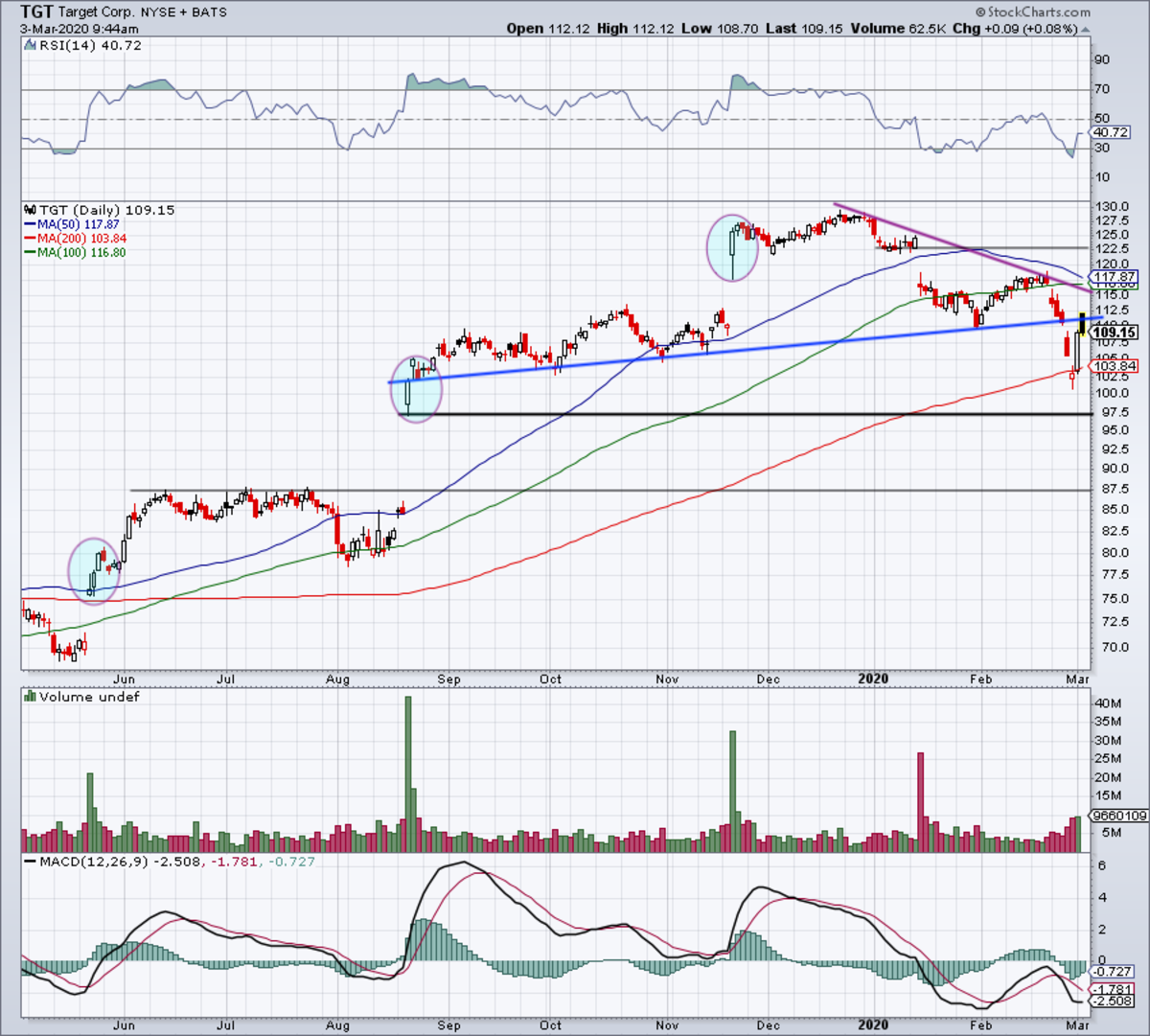

- Target Revenue a Bit Off Analysts' Target - Here's How to Trade the ...

- Target Stock Has Slumped in '23. Does the Chart Signal a Turnaround?

- Target Joins The Retailers Integrating Apple Pay

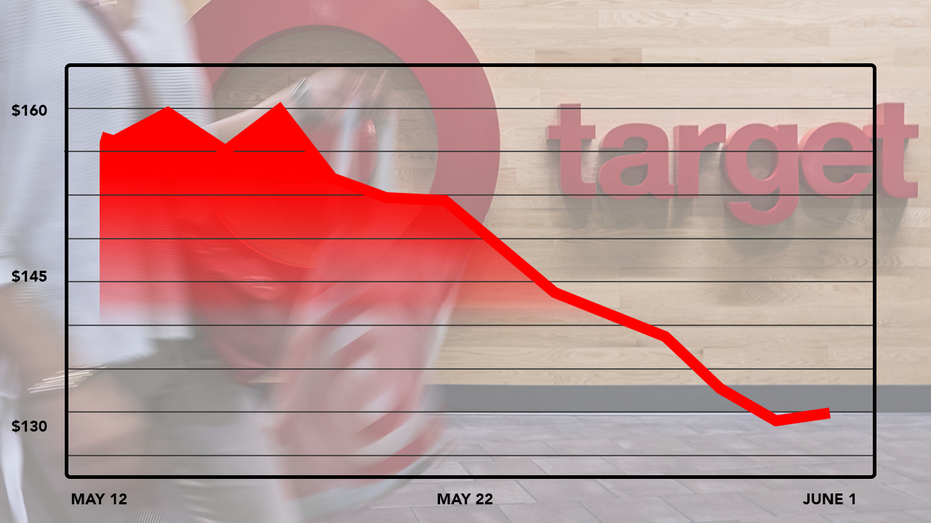

- Target shares hit three-year low, JPMorgan downgrades stock | Fox Business

- Target Stock Photos, Royalty Free Target Images | Depositphotos

- Elon Musk says Target can expect shareholder lawsuits soon as retailer ...

Introduction to Target Corporation

TGT Stock Price Quote - Morningstar

Key Drivers of TGT Stock Price

Several factors contribute to the TGT stock price quote, including: Omni-channel retailing: Target's efforts to integrate its online and offline channels have paid off, with online sales growing by over 20% in the last quarter. Store remodels: The company's strategy to revamp its stores has led to increased customer traffic and sales. Private label brands: Target's private label brands, such as Cat & Jack and Threshold, have been successful in attracting price-conscious customers. Partnerships and collaborations: Target's partnerships with popular brands like Disney and LEGO have helped to drive sales and increase brand visibility. In conclusion, the TGT stock price quote as per Morningstar indicates a strong potential for growth and investment. With its solid financial position, successful omni-channel retailing strategy, and popular private label brands, Target Corporation is well-positioned to continue its growth trajectory. As the retail landscape continues to evolve, Target's ability to adapt and innovate will be crucial in maintaining its competitive edge. For investors looking to diversify their portfolio, TGT stock is definitely worth considering.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please consult with a financial advisor before making any investment decisions.

Note: The article is written in HTML format with header tags (h1, h2) and paragraph tags (p) to make it SEO-friendly. The word count is approximately 500 words.