Table of Contents

- Irmaa Brackets 2025 - Karen Arnold

- Irmaa 2024 Brackets And Premiums Chart Pdf - Vyky Regine

- Possible 2025 IRMAA Brackets

- Irmaa Brackets 2025 - Karen Arnold

- Irmaa Brackets 2025 Medicare - Theo Bernadina

- Medicare Premiums and Coinsurance in 2025 - Meld Financial

- what are the irmaa brackets for 2023

- Irmaa Brackets 2025 Medicare - Theo Bernadina

- Irmaa 2025 Part D - Madge Ethelda

- Medicare Premiums and Coinsurance in 2025 - Meld Financial

What is IRMAA?

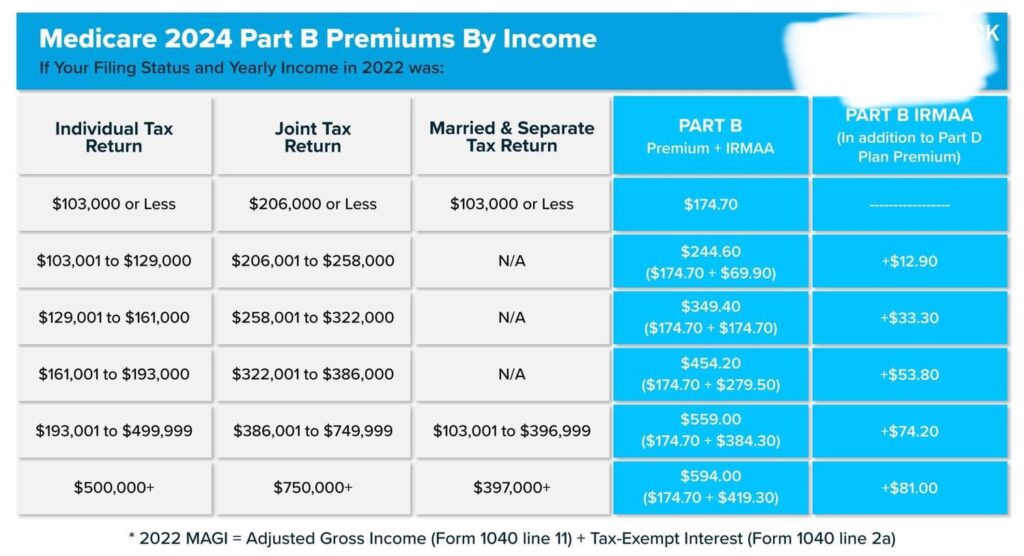

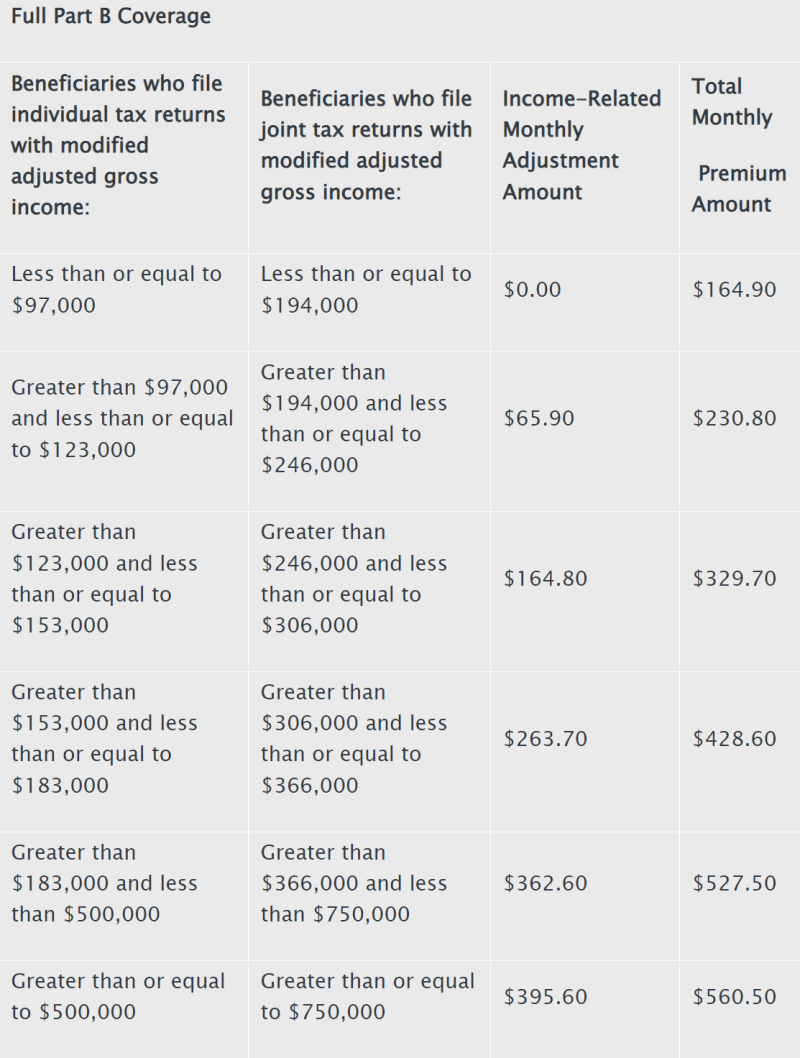

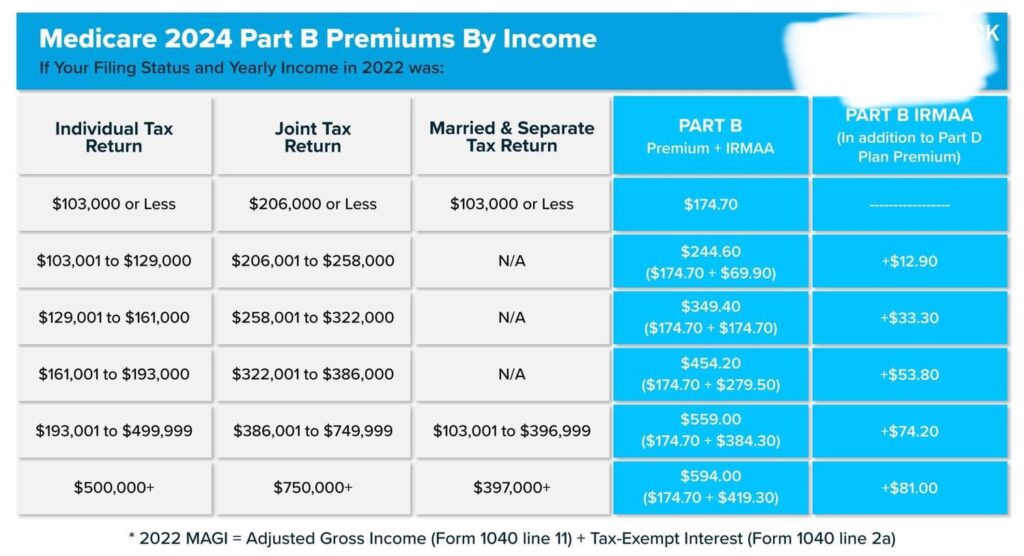

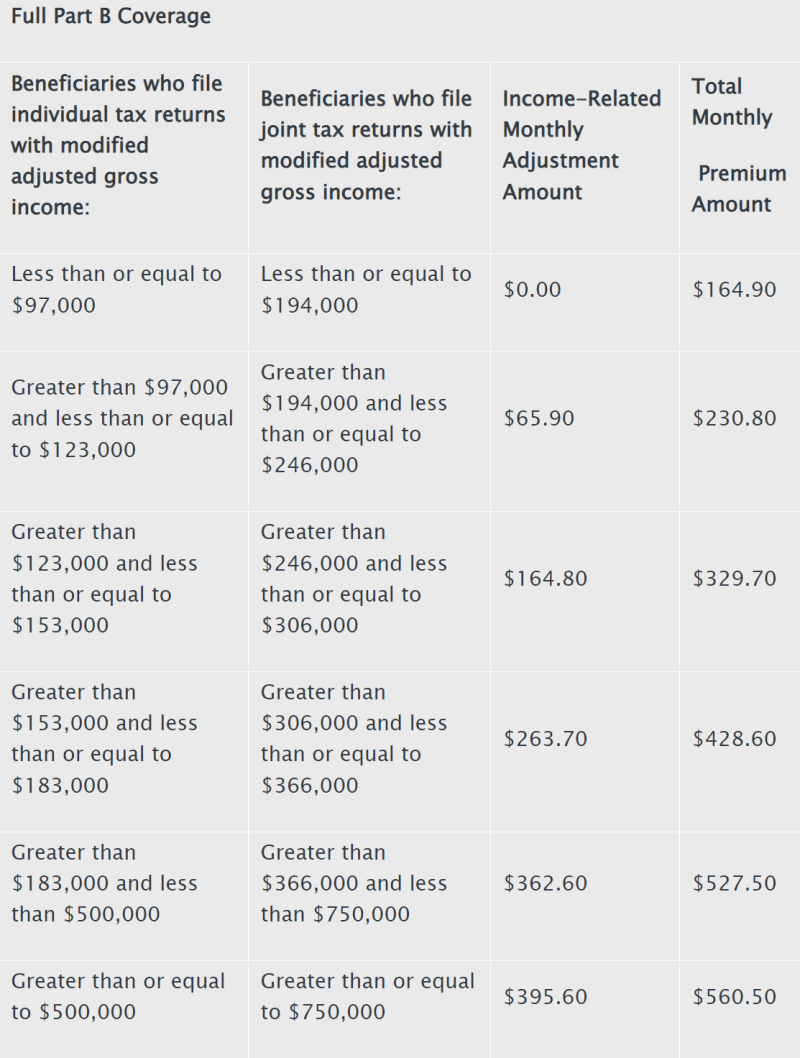

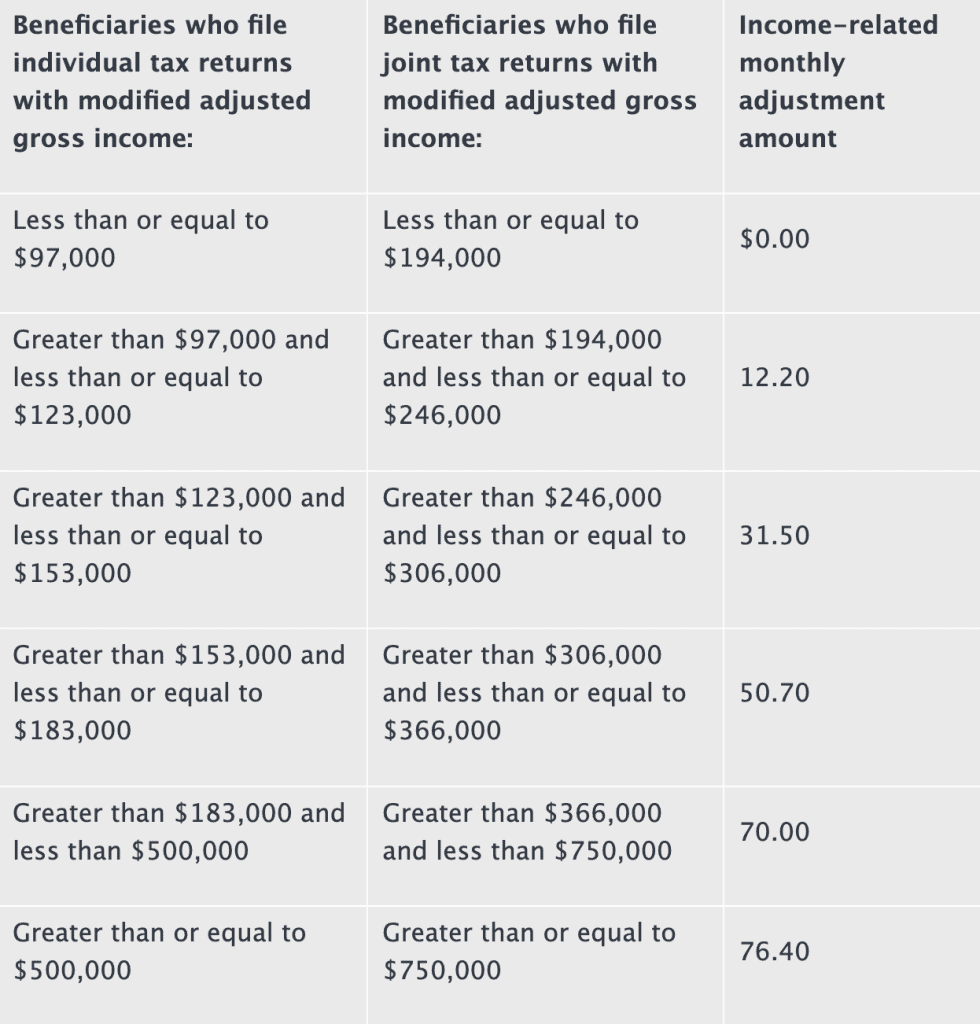

2025 IRMAA Chart

How to Reduce Your IRMAA Surcharge

If you're concerned about the impact of the IRMAA surcharge on your Medicare premiums, there are steps you can take to reduce your surcharge. Consider the following: Review your income: If your income has decreased since the last tax year, you may be eligible for a reduction in your IRMAA surcharge. Appeal your surcharge: If you've experienced a life-changing event, such as retirement or divorce, you may be able to appeal your IRMAA surcharge. Consult a Medicare expert: A licensed insurance agent or broker can help you navigate the complexities of Medicare and IRMAA. The 2025 IRMAA chart is an essential tool for Medicare beneficiaries to understand their potential surcharges on Medicare Part B and Part D premiums. By reviewing the chart and taking steps to reduce your surcharge, you can ensure you're getting the most out of your Medicare coverage. Visit medicaresolutionsnetwork.com to learn more about the 2025 IRMAA chart and how to navigate the complexities of Medicare.Download the 2025 IRMAA chart PDF to stay informed about the latest changes to Medicare surcharges.