The bond market is a vital component of the global financial system, providing a platform for governments and corporations to raise capital and for investors to generate returns. In this article, we will delve into the world of bonds, exploring the bond market, prices, rates, and their impact on the economy. Whether you're a seasoned investor or a novice, this guide will provide you with a thorough understanding of the bond market and its intricacies.

What are Bonds?

Bonds are debt securities issued by borrowers to raise capital from investors. When you buy a bond, you essentially lend money to the issuer, who promises to repay the principal amount with interest. Bonds can be issued by governments, corporations, or other entities, and they offer a relatively low-risk investment opportunity. The bond market is a vast and liquid market, with a wide range of bonds available, including government bonds, corporate bonds, municipal bonds, and high-yield bonds.

The Bond Market

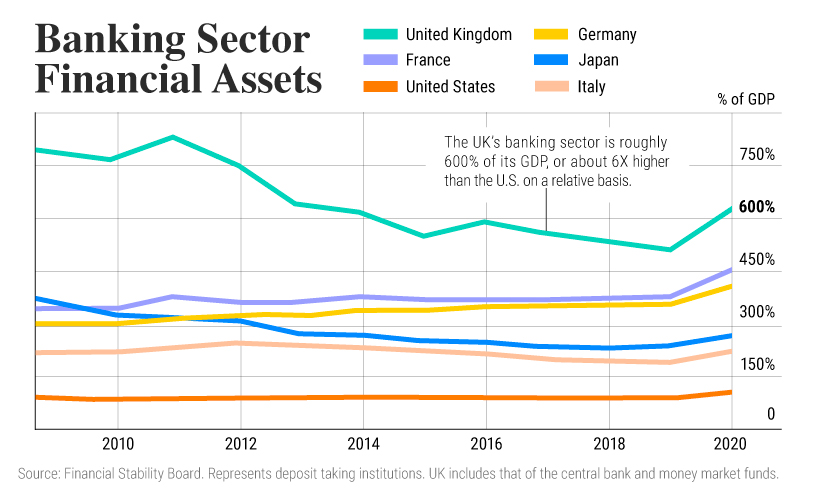

The bond market is a decentralized market where bonds are bought and sold. It is a vast market, with trillions of dollars' worth of bonds traded daily. The bond market is influenced by various factors, including interest rates, inflation, economic growth, and geopolitical events. The market is also subject to fluctuations, with bond prices and yields changing constantly.

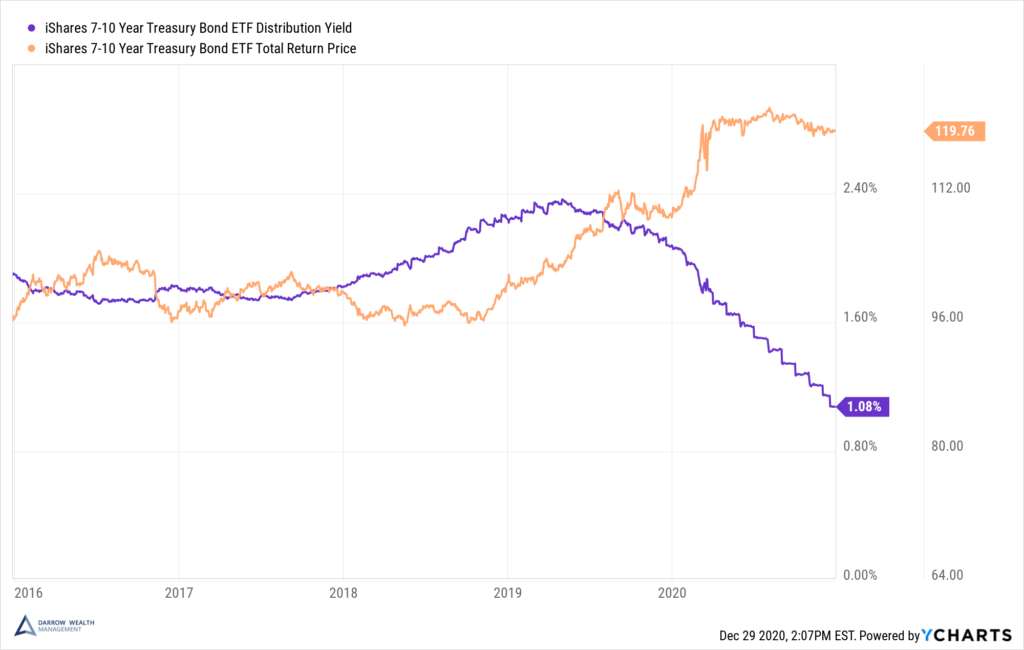

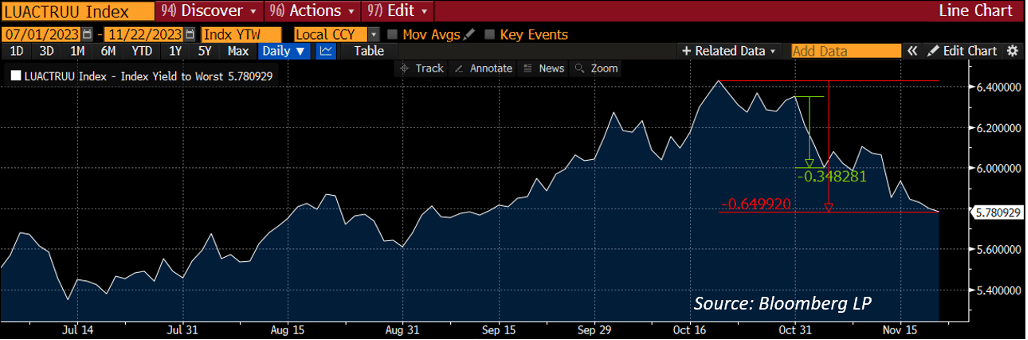

Bond Prices and Rates

Bond prices and rates are closely linked. When you buy a bond, you pay a price, which is typically expressed as a percentage of the bond's face value. The price you pay will determine the yield, or return, you receive on your investment. The yield is calculated by dividing the annual interest payment by the bond's price. For example, if you buy a bond with a face value of $1,000 and an annual interest payment of $50, and you pay $900 for the bond, the yield would be 5.56% ($50 ÷ $900).

Types of Bond Rates

There are several types of bond rates, including:

Coupon Rate: The interest rate paid periodically to bondholders.

Yield to Maturity: The total return on investment, including interest payments and capital gains or losses.

Current Yield: The annual interest payment divided by the bond's current price.

Factors Affecting Bond Prices and Rates

Several factors can impact bond prices and rates, including:

Interest Rates: Changes in interest rates can significantly affect bond prices and yields.

Inflation: Rising inflation can lead to higher interest rates and lower bond prices.

Economic Growth: A strong economy can lead to higher interest rates and lower bond prices.

Geopolitical Events: Global events, such as wars or natural disasters, can impact bond markets and prices.

The bond market is a complex and dynamic market, influenced by a wide range of factors. Understanding bonds, prices, and rates is essential for investors and financial professionals alike. By grasping the concepts outlined in this article, you'll be better equipped to navigate the bond market and make informed investment decisions. Whether you're looking to generate returns or manage risk, the bond market offers a range of opportunities. Stay up-to-date with the latest market trends and analysis from

Markets Insider to make the most of your investments.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.